My Medical Benefits

Forms

Documents

To find a provider, click the drop-down arrow next to “Harvard Pilgrim and UnitedHealthcare”, and select “HPHC and UnitedHealthcare Options PPO”.

My Care Coordination Benefits

MIS (an Xceedance company) has partnered with your HPI medical plan to bring you CancerCARE, an additional benefit that provides care coordination services for members diagnosed with cancer. They are your cancer advocates and will work tirelessly to support you and your dependents through this difficult time.

CancerCARE is available to help you from the day of your diagnosis and beyond. You can register for the program at any point in your cancer journey to gain access to their services.

How it Works

Once you are part of the program, a dedicated nurse will be with you every step of the way. This nurse will be available to answer any questions you might have as well as receive ideal treatment.

Through CancerCARE, you will have access to some of the best doctors, hospitals, and technology nationwide. We will work with your local oncologist to make sure all treatment options are considered, not just local ones.

Our medical staff has decades of experience treating cancer, and we pride ourselves on staying up-to-date with the latest cancer treatments and technology. Each medical staffer has unique cancer expertise and background.

Eligibility

All team members who work at least 30 hours a week are eligible.

My KISx Card

As healthcare costs rise, Xceedance pays close attention to how this will impact team members and their families. To combat costs, we have partnered with KISx Card, a surgery & imaging program that allows you to save big on the most common surgical and imaging procedures.

Eligibility

All team members who work at least 30 hours a week are eligible.

My Pharmacy Benefits

MIS (an Xceedance company) has partnered with SmithRx to manage your pharmacy benefits and address the increasing costs of medications. SmithRx works with you and your doctor to find the drug you need at the lowest possible cost. It is important to take their calls, as it will help you save money!

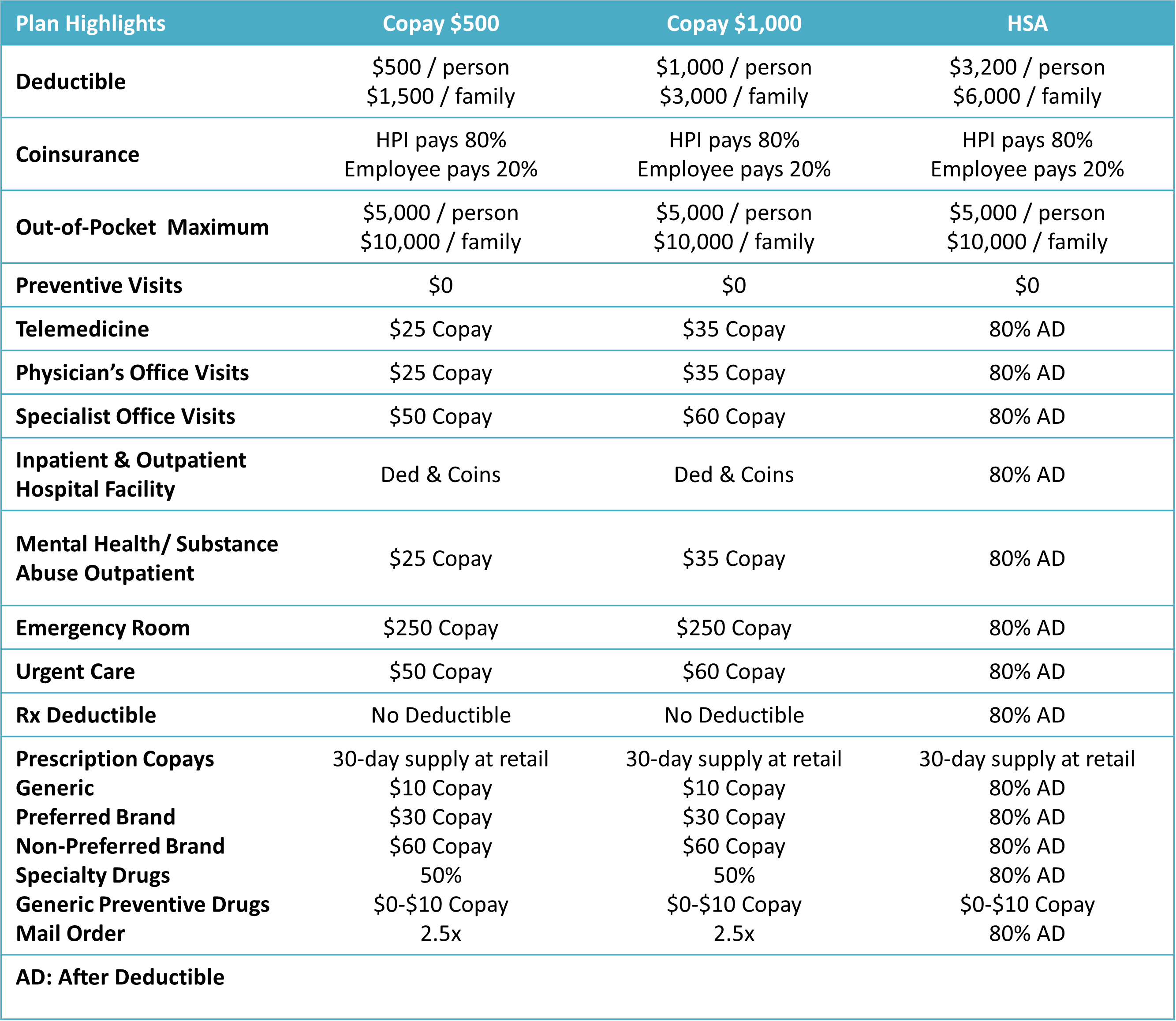

The amount you will pay for your prescriptions depends on which medical plan you elect and which tier drug you are taking.

What is a Formulary?

A Formulary is a list of drugs covered by a prescription drug plan. The brand name drugs listed on the formulary are deemed most effective to treat the condition and are the most cost effective. The generic drugs listed on the formulary are also effective, they are just lower cost because they have been around longer.

Traditional vs. Specialty Medications

Traditional medications are used to treat general health and chronic conditions such as flu, diabetes, or a common infection and can be broken into the following categories:

- WELLNESS- drugs that are prescribed to prevent a disease or condition or help you manage an

existing issue - GENERIC- same active-ingredient formula as a brand-name drug at a lower cost

- PREFERRED BRAND- brand name drugs that are on the SmithRx Formulary

- NON-PREFERRED BRAND- brand name drugs that are not on the SmithRx Formulary

Specialty medications are used to treat complex and rare diseases, such as cancer, multiple sclerosis, and rheumatoid arthritis.

Depending on the drug you are taking, you may have to complete some additional steps to obtain your medication, such as obtaining a prior authorization.

Find My Meds Tool

With SmithRx’s Find My Meds tool, you can easily search for the online or retail pharmacy near you where you can get your drugs for the lowest out of pocket cost. This tool considers your current pharmacy plan benefits so you see not just an estimated price but the actual amount you will be charged.

To access the Find My Meds tool, log into your SmithRx member portal at member.mysmithrx.com/login.

Eligibility

All team members who are enrolled in the medical plans.

Contact Information:

Prescription Coverage – Smith Rx

844-454-5201

To view the most current drug list, log into your profile on SmithRx and then click on “Documents” and then “Your Formulary.”

Forms and Documents

My Telehealth Benefits

Offered through your medical plan, Doctor on Demand grants you access to virtual care 24/7. Services include medical urgent care and behavior health visits.

Their physicians can treat many conditions, including:

- Coughs/colds/flu

- Sore/strep throat

- Sinus and allergies

- Nausea/diarrhea

- Rashes and skin issues

- Women’s health

- Sports injuries

Doctor on Demand can also be utilized for behavioral health needs, providing both psychologists and psychiatrists.

With Doctor on Demand, your telehealth visit co-pay is equal to your PCP/office visit co-pay.

Contact Information

Doctor On Demand® Telehealth: Online Doctors Available 24/7

support@doctorondemand.com

800-997-6196

My Health Savings Account (HSA)

Health Savings Account

A Health Savings Account (HSA) is paired with the H.S.A. Medical Plan. The HSA helps you and your family plan, save, and pay for qualified health care expenses. A Health Savings Account empowers you to build savings for health care expenses in a tax-advantaged account.

About Health Savings Accounts

A Health Savings Account (HSA) is a tax advantaged savings account that you own and control. HSAs are like retirement accounts in that they rollover year-to-year, they are portable when you move jobs or retire, the balance can be invested in mutual funds, and there are survivor benefits.

Who Is Eligible?

You must be enrolled in the medical plan and meet the following requirements:

- Be enrolled in the HSA Plan

- Have no other health insurance coverage except what’s permitted by the IRS

- Not be enrolled in Medicare

- Not be claimed as a dependent on someone else’s tax return

What Is A Qualified Health Care Expense?

You can use money in your HSA to pay for any qualified health care expenses for you, your spouse and your tax dependents, even if they are not covered on your qualified medical plan. Examples of qualified expenses include: your insurance plan deductibles, copayments, and coinsurance; doctor’s office visits; prescriptions; dental treatments and x-rays; eyeglasses, contacts, and vision exams.

How Much Can I Contribute To A Health Savings Account?

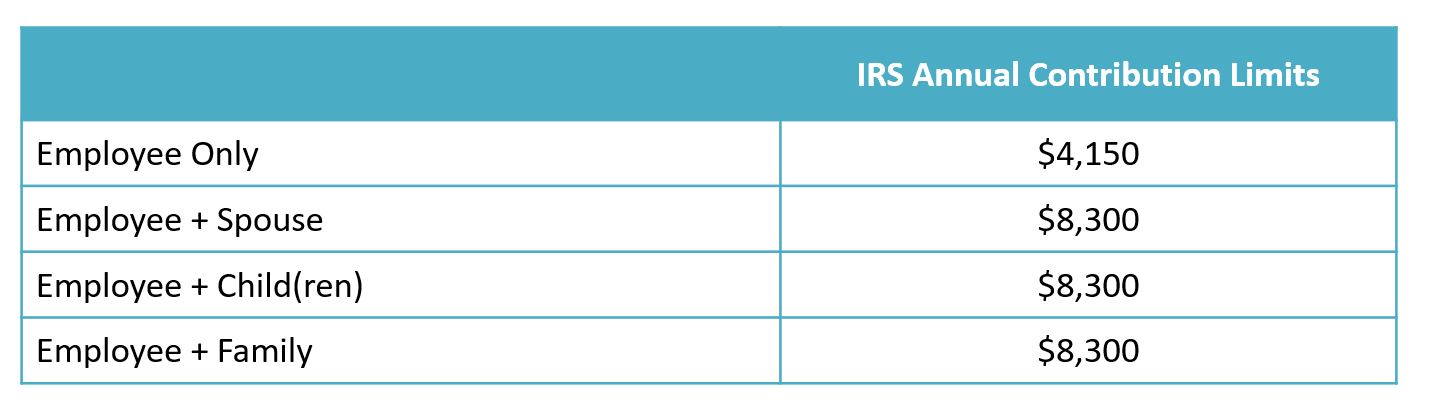

Each year the IRS establishes the maximum contribution limit. The chart below represents the IRS limits for 2024. These limits are for the total funds you can contribute. Please keep in mind you can change your HSA allocation at any time during the plan year (as permitted by Human Resources and Payroll).

Contributions

Forms and Documents

My Flexible Spending Account

Flexible Spending Accounts

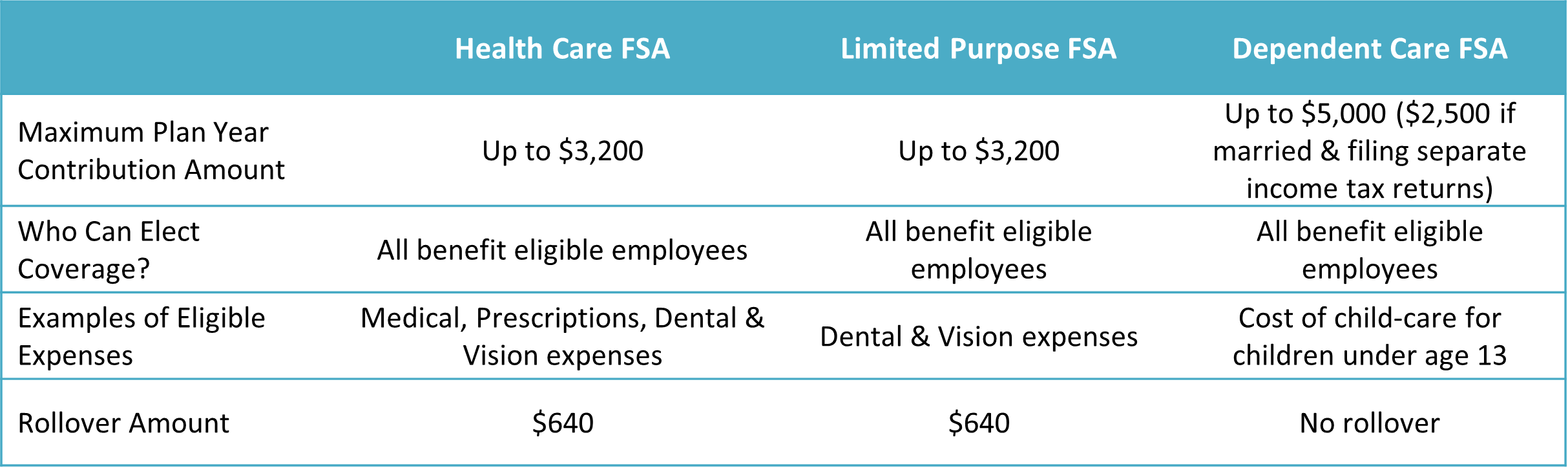

Xceedance offers a Health Flexible Spending Account for out of pocket medical, dental, and vision expenses along with the Dependent Care FSA. These are voluntary accounts.

Health FSA

- Annual contribution limits are $3,200 for 2024

- Can be used for medical, dental and vision expenses

- Up to $640 of unused funds will roll over to the next year

Dependent Care FSA

- Annual contribution limit is $2,500 (if married and filing separate returns) or $5,000 (if married filing a joint return or head of household) for 2024

- Can be used for qualified dependent care expenses

- e.g. daycare, field trips, after- school care, day camp, etc.

Contributions

FSA/HSA Store

Xceedance has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

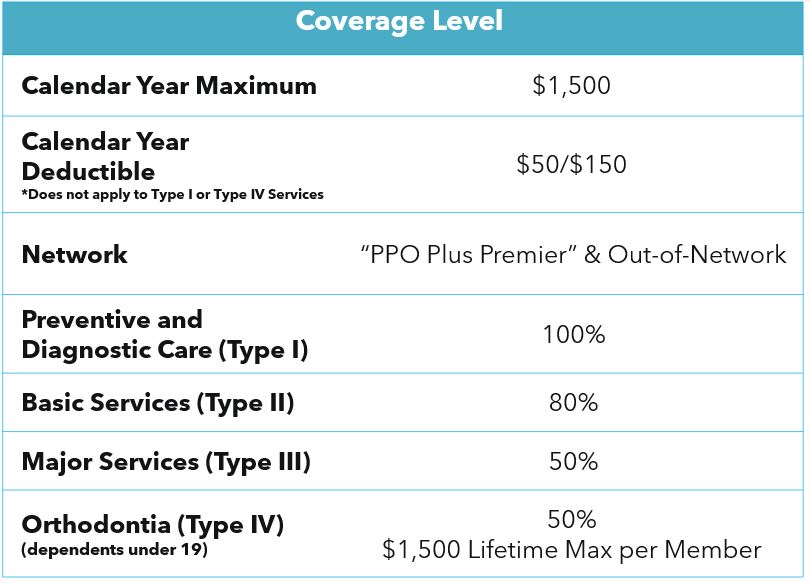

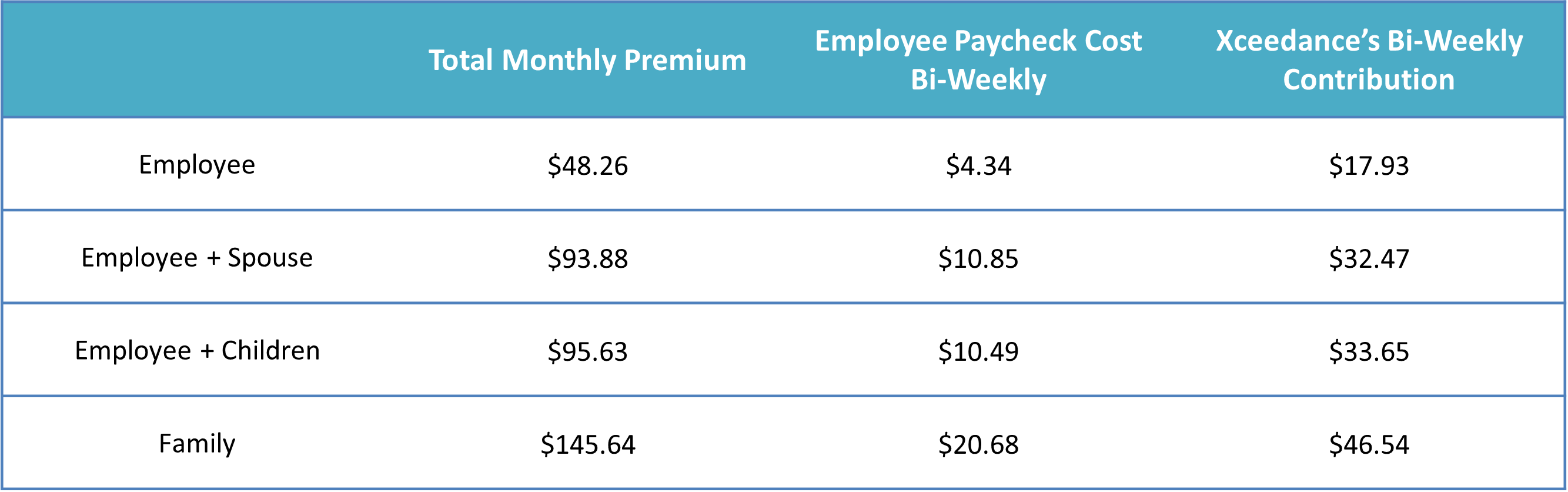

My Dental Benefits

Xceedance offers one dental plan to team members through Delta Dental.

Contributions

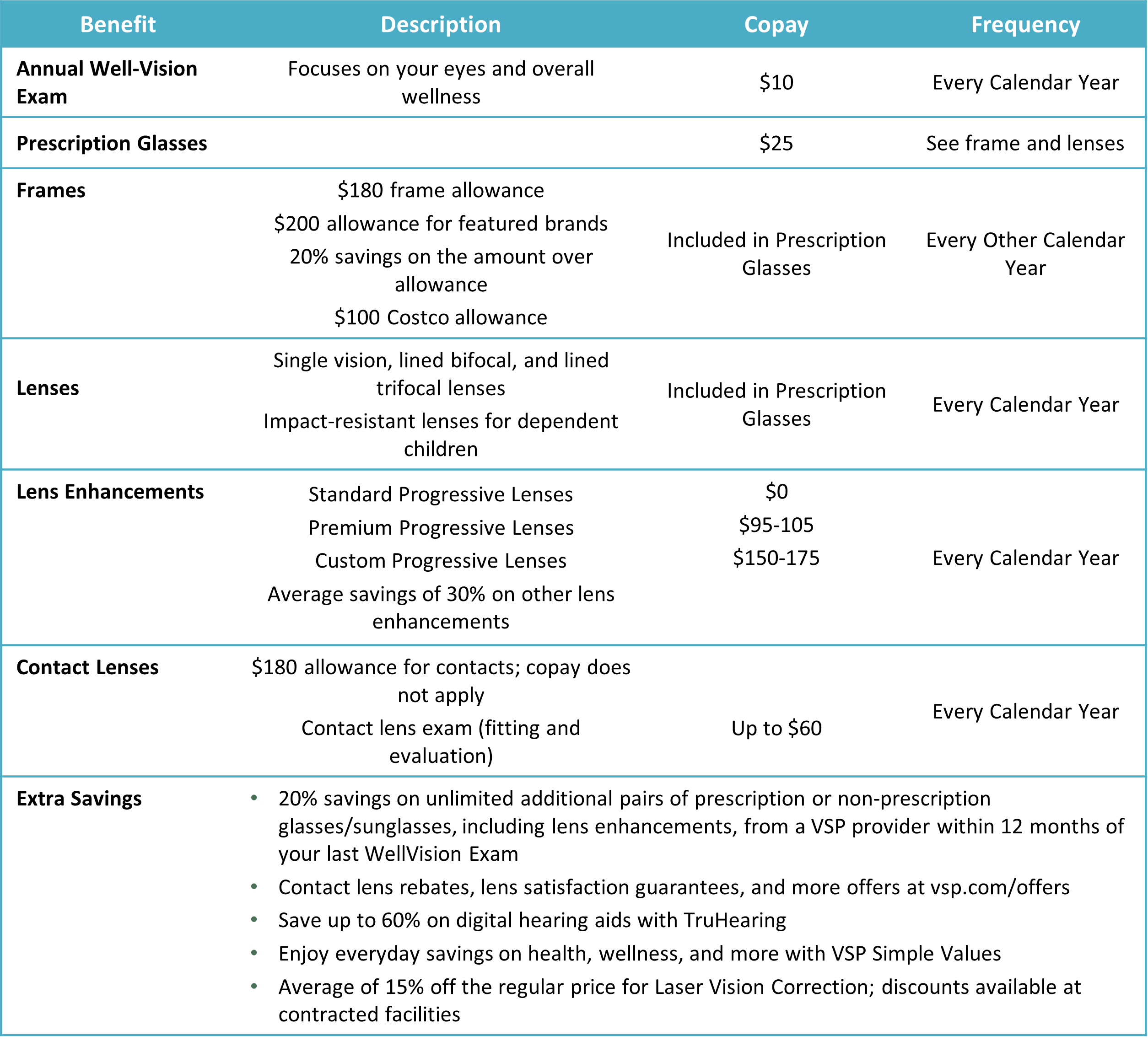

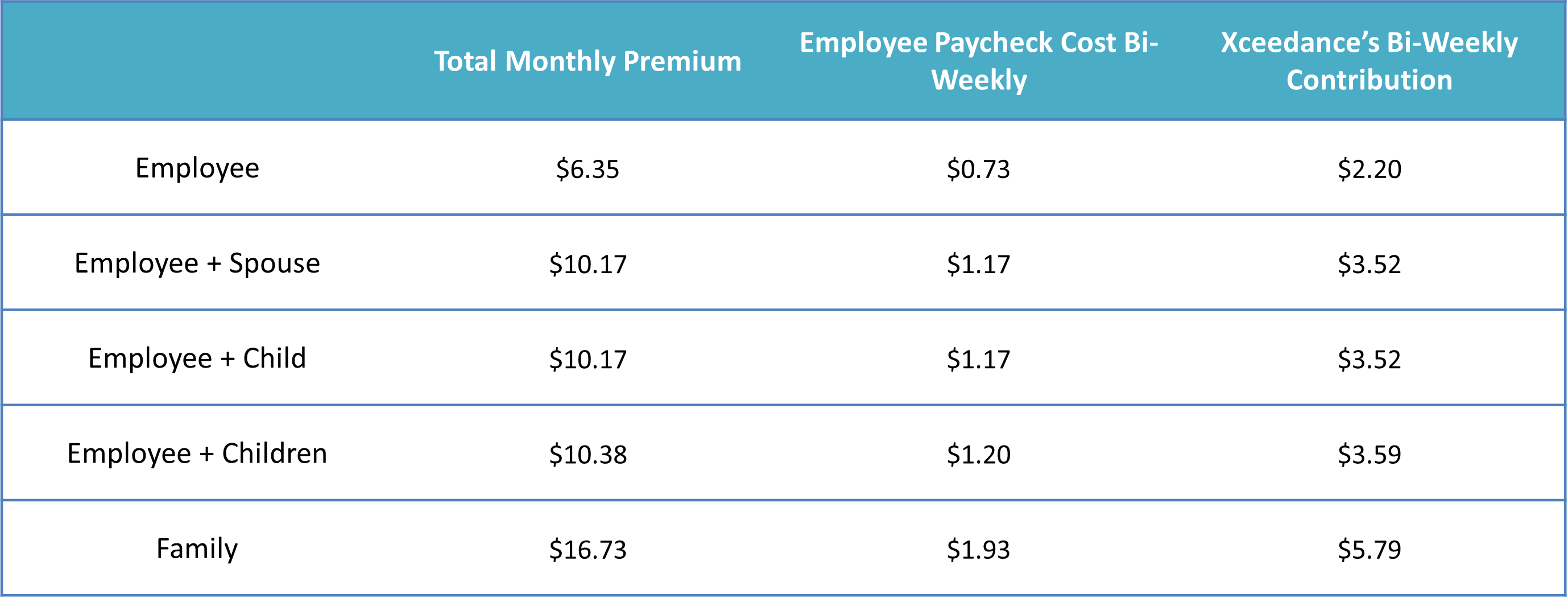

My Vision Benefits

Xceedance offers one voluntary vision plan to team members through VSP.

Plan Details

Contributions

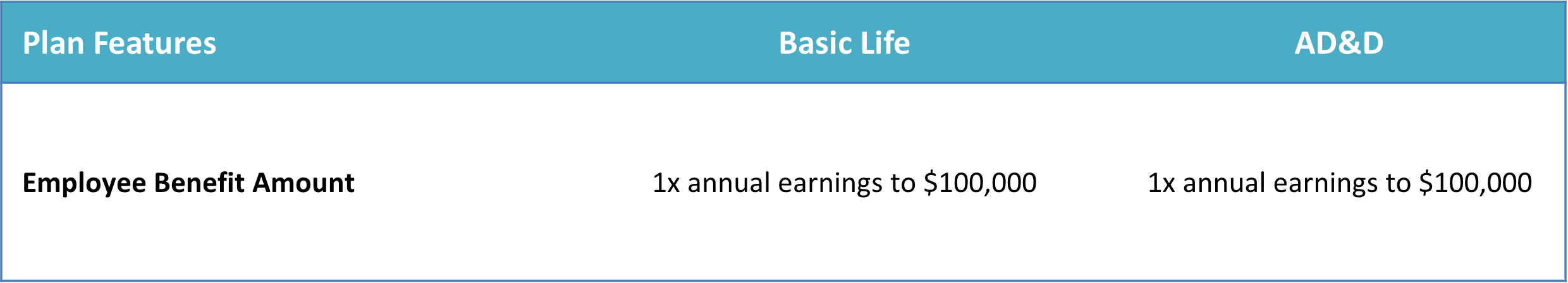

My Employer Paid Life and AD&D Insurance

Xceedance offers employer paid Life and AD&D to team members through Unum.

Life & AD&D

Life insurance will pay your beneficiary a lump-sum payment if you should pass away while covered under the term of this policy. The money can help your family pay for basic living expenses, final arrangements, tuition, and more.

AD&D insurance can pay a benefit if you survive an accident but have certain serious injuries. It can pay an additional amount if you die from a covered accident.

Eligibility

Team members working a minimum of 30 hours a week.

My Employer Paid Short-Term Disability

Xceedance provides Short-Term Disability benefits to all team members through Unum.

Short-Term Disability

Short-Term Disability can replace a portion of your income when you’re unable to work as the result of an injury or illness lasting a few weeks to a few months.

Your employer-paid STD benefit covers many conditions that keep you from working, including:

- Recovering from regular pregnancy

- Joint disorders

- Injuries

- Behavioral health issues

- Digestive disorders

Details

- Weekly benefit amount is 60% of earnings

- Maximum duration of benefits is 26 weeks

- Maximum weekly benefit is $2,000

- Minimum weekly benefit is $25

- Takes effect immediately following injury and 7 days following illness

Eligibility

Short-Term Disability is available to all full-time team members working at least 30 hours per week.

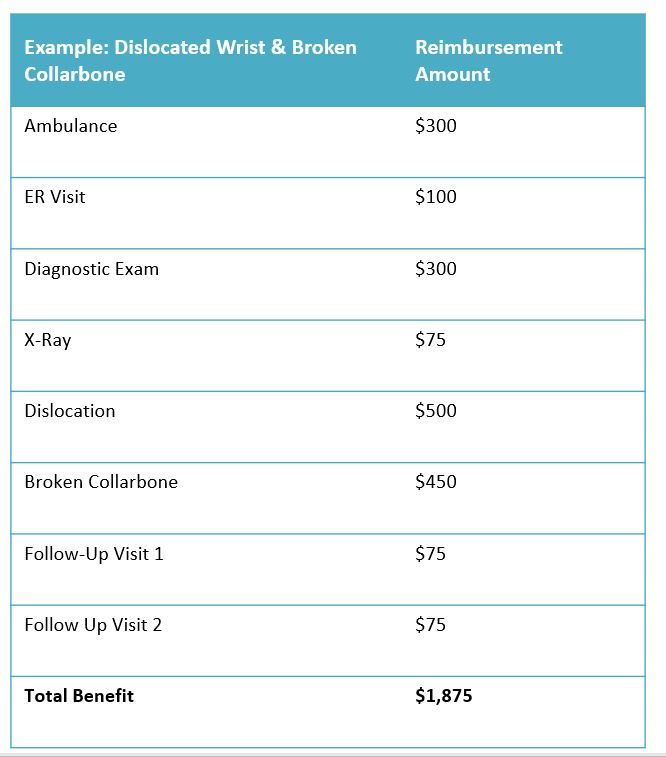

My Voluntary Ancillary Benefits

Xceedance offers voluntary benefits to all eligible team members through Unum.

Accident

Accident insurance can pay a set benefit amount based on the type of injury you have and the type of treatment you need. It covers accidents that occur on or off the job. And it includes a range of incidents, from common injuries to more serious events. There is a $50 Be Well benefit included in Accident Insurance.

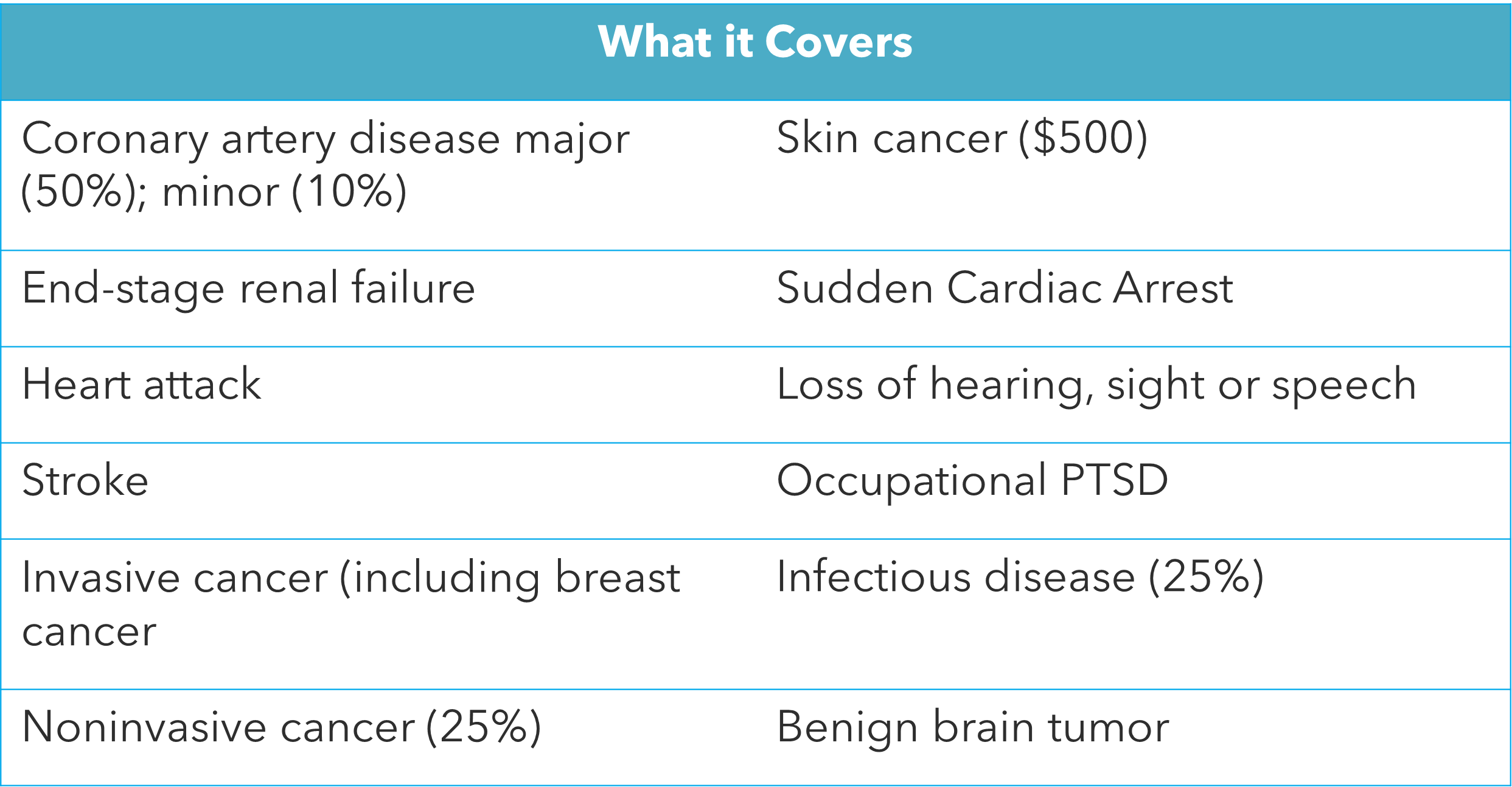

Critical Illness

This plan pays a lump sum cash benefit to help with out-of-pocket medical and indirect non-medical expenses related to critical illness such as: cancer, heart attack, or stroke.

- You can buy coverage amounts of $10,000 or $20,000, as applied for and approved by Unum.

- Guaranteed issue coverage up to $20,000 (50% of team member coverage amount for spouse and 50% of team member coverage amount for child)

- There is a Be Well benefit of $50 per person per year.

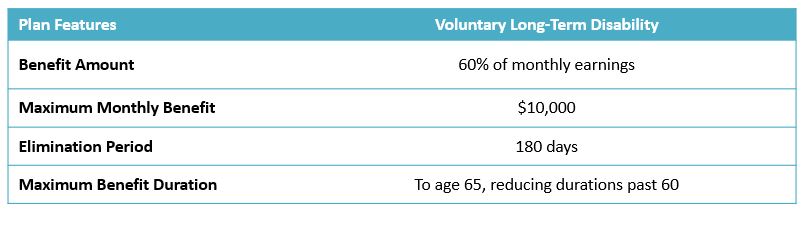

Voluntary Long Term Disability Insurance

Your Voluntary LTD benefit covers many conditions that keep you from working, including:

- Joint disorders

- Cancer

- Behavioral health issues

- Injury and poisoning

- Circulatory diseases

Voluntary Life & AD&D

Xceedance provides you the opportunity to purchase additional life insurance coverage for yourself, your spouse and your dependent children to age 20 or 26 if they are a full-time student. However, you may only elect coverage for your dependents if you elect additional coverage for yourself.

Employee Life & AD&D

- You can purchase coverage in $10,000 increments

- Maximum amount is 5x earnings or $500,000

- Guaranteed Issue to $150,000 (if currently participating, you can increase your benefit during Open Enrollment up to the Guaranteed Issue amount)

Spouse Life & AD&D

- You can purchase coverage in $5,000 increments

- Maximum is the same as employee (self) election

- Guaranteed Issue to the lesser of 100% employee amount or $25,000

Child Life & AD&D

- You can purchase coverage in $2,000 increments

- Maximum benefit is the lesser of 100% of the Employee Life amount or $10,000 as applied for by the employee and approved by Unum

Eligibility

All team members who work at least 30 hours a week.

Forms

Accident

Critical Illness

Long Term Disability

Vol Life & AD&D

My Pet Insurance

Xceedance offers Pet Insurance through PinPaws!

Benefits of Pet Insurance through Pin Paws:

- Coverage for Cats and Dogs of All Ages and Breeds*

- No Initial Exam/ Past Vet Notes Required

- Accident Coverage Starts at Midnight

- Customizable Deductible and Out- of- Pocket Max

- Annual Max Payouts as Opposed to Per Incident

- Choose Your Reimbursement Percentage

- Multiple Value- Added Benefits Included

- Routine Care Option Available with Customized Plans*

- Available in all 50 States!

How long does a claim take?

The average time from start to finish when submitting a claim to MetLife is 10 business days.

What is Pin Paws Pet Care and what are the different options?

The Pin Paws Pet Care (pet insurance) plan is an accident and illness policy for dogs and cats. We do offer a Wellness Rider for an additional cost. Our Standard Wellness Rider is an excellent choice for pet parents who would like coverage for routine and preventative expenses in addition to their pet insurance coverage.

What does standard wellness cover?

Standard Wellness covers the cost of the following:

- Annual vet exam

- Lab work

- Recommended vaccinations

- Teeth cleaning

- Spay and Neuter Services

- Flea, Tick, and Heartworm Prevention

To sign up go to: pinpaws.com/xceedance

Enter XCEEDANCE at checkout in the group code slot.

My Retirement

Xceedance offers a 401(k) retirement plan through John Hancock and wealth management services through Twelve Points.

You can set up your account with John Hancock by going to myplan.johnhancock.com or by downloading John Hancock’s retirement app.

Have questions about retirement, 401(k) investing, or other life events? You can schedule a Rapid Review session with Twelve Points Wealth Management at twelvepointswealth.com/rapidreview.

Twelve Points hosts webinars designed to provide insight and educate you on specific and relevant financial topics.

You can view the full list of 2024 webinars with registration links in the flyer below:

My Medicare Navigation

Medicare Navigation

Medicare is very complex and it is important that you have an advocate who can provide you the proper Medicare education and guidance.

There are different paths you can choose in Medicare plans and it can be very time consuming and difficult to filter through these options yourself. It is important that you find the appropriate plan in your area that best fits your medical needs and is within your financial budget.

SmartConnect is a free resource that will simplify the Medicare approach by providing you the needed education, plan evaluation and enrollment assistance.

My Tuition Assistance Benefits

Xceedance’s tuition assistance program is designed to help team members pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new benefit program that is revolutionizing the way team members can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Information

Phone: (844) GRADFIN

For more information or to schedule a one-on-one consultation visit:

Plan Information

My Employee Assistance Program

Employee Assistance Program

Unum’s EAP is designed to help you lead happier and more productive lives at home and at work. When you have problems, you can work with Licensed Professional Counselors to define the problem and obtain appropriate assistance.

Through the EAP, all team members and their household members can get help with personal, family and work issues such as:

• Stress, depression, anxiety

• Relationship issues, divorce

• Job stress, work conflicts

• Family and parenting problems

• Anger, grief and loss

• Addiction, eating disorders, mental illness

The Licensed Professional Counselor will either address concerns during a few initial sessions or refer you to other appropriate counselors or community resources for long-term help.

You are eligible for 3 face-to-face counseling sessions per individual issue.

Work-Life Balance Services

Team members can also reach out to our Work-life Specialists for help with balancing the demands of home, family and the workplace. Our specialists can answer questions, as well as put team members in touch with outside resources. Work-life Specialists can help find:

Childcare Services

• Childcare centers

• Babysitter tips

• Family-run childcare homes

• Community resources

• Nanny agencies

• Pre-schools

Eldercare Services

• Assisted living facilities

• Nursing homes

• Independent living options

• Adult day-care services

• Geriatric care managers

• Services for adults with disabilities

Financial Services

• Debt management solutions

• Budgeting assistance

• Credit report assistance

Legal Services

• Personal/family and elder law

• Real estate

• Identity theft

Eligibility

EAP services are available to all eligible team members, their spouses or domestic partners, dependent children, parents and parents-in-law.